Seven years into a domestic recovery, the US economy remains sound although it encountered heavy weather in the first half of this year. “There is no doubt that slowing global demand did diminish trade and investment,” says Kevin Thorpe, Cushman & Wakefield’s global chief economist. “However, as the second half of the year unfolds, we expect those categories to pick up steam, supporting stronger corporate profits, inflation and real GDP growth.”

Continued Growth Projected for Construction Through 2017

Economists from the AIA, the National Association of Home Builders, and the Associated Builders and Contractors convened this week to deliver a midyear status update on the health of the construction sector. While recovery among the market sub-categories—commercial/industrial, multifamily, institutional, and single-family residential—has largely been uneven and will continue to be, the economist trio forecasts growth across the sectors through 2017.

“Revenue at architecture firms continues to grow, so prospects for the construction industry remain solid over the next 12 to 18 months,” said AIA chief economist Kermit Baker, Hon. AIA, in a press release. “Given current demographic trends, the single-family residential and the institutional building sectors have the greatest potential for further expansion at present.”

Ergonomics not evolving quickly enough for the modern workplace, says Haworth

Haworth white papers: working styles are changing, but ergonomic design is stuck in the days of the "cubicle farm" and not evolving quickly enough to support more mobile employees, according to US furniture giant Haworth.

"The very nature of work is changing," says Haworth in its white paper Active Ergonomics for the Emerging Workplace. "Technology has freed people to work anywhere, and a growing proportion of that work is collaborative and social."

"But traditional office ergonomics does not address group work or spaces. These emerging space types are being created with no ergonomic guidance," it warns. "Organisations that fail to apply a 'big picture' approach to office ergonomics are missing the opportunity to provide a safe and high-performing workplace for their employees."

The Office Market is Strong, But Still Overshadowed by 2015

The first half of the year has proven the U.S. office game is still strong, but 2015's banner year will be hard to beat. The volume of office sales completed in the first half of 2016 has dipped compared to the same time last year, according to early CoStar data. Hans Nordby, managing director for CoStar Portfolio Strategy, labeled this latest statistic "a worry" because a drop in transaction volume "generally portends a decrease or at least a flattening in prices."

CHOPPY WATERS FOR HOTEL INVESTMENT

Despite still strong fundamentals in hotel operating performance, the capital markets environment for the hotel sector has been going through choppy waters this year. A brief review of key investment metrics illustrates some of the challenges.

Tepid hotel investment activity continued in Q2 2016. U.S. hotel acquisitions totaled $6.5 billion in Q2 2016, down 50% year-over-year. Similarly, the H1 2016 total reflects a 55% decline from H1 2015.

Fortunately, the year-over-year drop in single-asset purchases was less severe. Buying activity of individual assets provides a better measure of investment momentum, and H1 2016’s $11 billion total reflected a more moderate drop of -33% compared to last year.

Chicago: Office Market Looking Good For 2016

The 2016 Chicago office market continued to improve in the second quarter, and the CBD’s direct vacancy rate sank 32 bps from 11.97% at the end of the first quarter to 11.65%, its lowest point since 2008, according to a market overview just published by MBRE.

Perhaps the most important events in the quarter were that developers broke ground on another two office towers in the West Loop, bringing the total amount of new space under construction or announced to roughly 4.4 million square feet. But with a sizable amount of this new space already pre-leased, the prospects to absorb the rest without a big boost in the vacancy rate appear good.

Office Reports are Strong for Q2 - With Some Caveats

The US national office vacancy rate dropped 10 basis points from Q1 and fell below 16%, reaching its lowest point in seven years since the recession. Positive tenant growth fueled nearly half of that increased leasing, according to JLL’s Q2 report, which shows 46% of leases signed were corporate expansions.

Investors and landlords alike can breathe a sigh of relief—it seems fears of a slowdown in tech leasing were misplaced. At least for now. The sector was one of the largest drivers of growth this quarter with more than 56% of tech leases over 20,000 square feet representing expansions. And those expansions took place both within and outside of primary tech hubs—a further signal the industry is continuing to expand. Financial institutions were the other sector to take on the most space last quarter, said Julia Georgules, vice president of JLL research.

Q2 Office Leasing Steady While Retail Innovates

Putting negative predictions to rest, CBRE’s Q2 report sees signs of health in the Manhattan and Brooklyn office leasing markets, along with the city’s investment sales and retail sectors.

Substantial growth in 21st Century self employment in the UK

The 21st Century has seen an explosion of self employment in the UK, and most people who have become self employed have done so for positive reasons, claims a new report from the UK Government’s Office for National Statistics. According to the Trends in Self Employment Report, there are now more than 4.7 million people classified as self employed, around 15 percent of the workforce. There has been a marked upturn since the 2008 recession, an increase of 730,000 over that period. The trend to self employment has been evident since the turn of the Millennium when around 3.2 million people were classified as self employed. Between 2001 and 2015, part time self employment grew by 88 percent, compared to 25 percent for full time work, partly because of the growing number of workers choosing part time self employment before retirement. The report describes the changes as structural, which suggests that the growth will continue.

Office Outlook In A Word: ‘Vigorous’

Office vacancy rates might still hover higher than pre-recession averages, but the outlook for the market remains positive, reports Marcus & Millichap in its Summer 2016 Office Outlook. (Marcus & Millichap is a GlobeSt.com Thought Leader.)

The U.S. Adds 287,000 Jobs in June

The U.S. economy rebounded from a sluggish May, surpassing analyst expectations to add 287,000 nonfarm payroll positions in June, according to the latest monthly employment report from the Bureau of Labor Statistics, released this morning. June's seasonally adjusted figure represents a spur in hiring from May, during which the downward-revised addition of just 11,000 jobs reflected a six-week strike by 35,000 Verizon employees, among other factors, and it comes as a relief to the tumbling market, putting a damper on concerns of an economic slowdown.

Is the Tech Bubble Popping? Ping Pong Offers an Answer

Falling table-tennis sales give a peek into the economics of Silicon Valley, where the right to play on the job is sacrosanct.

ABC: Nonresidential spending slip in February no cause for alarm

Nonresidential construction spending dipped in February, falling 1.4% on a monthly basis according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. While this represents a step back from January's figure of $700.3 billion (revised down from $701.9 billion), it is still 1.5% higher than the level of spending registered in December 2015 and 10.1% higher than February 2015.

ISM Manufacturing Index Expands in March

U.S. factory activity expanded in March for the first time since last summer, a sign the nation’s economy is slowly shaking off the effects of a strong dollar and depressed oil prices.

ADP: 200,000 Jobs Added in March

The construction sector posted another strong month as overall payroll gains continue the trend of the last four years. The U.S. economy added 200,000 private non-farm jobs in March, according to a monthly employment report released today by payroll-processing company ADP and its partner Moody’s Analytics. Of those gains, 43 percent came from business with fewer than 50 employees. The seasonally adjusted monthly figure is on par with February’s downward-revised 205,000 payroll additions, matching job-growth trends over the past four years and reflecting a tightening in the labor market with steady increases across regions and sectors, said Moody’s chief economist Mark Zandi in a conference call this morning.

Read more about employment numbers on architectmagazine.com >

Digital Transformation Requires Total Organizational Commitment

By now you’ve surely heard that moving forward, every company will be a software company, and that shift is happening now as companies large and small scramble to transform into digitally-driven organizations. Wherever you turn, businesses are facing tremendous disruptive pressure. What’s interesting is that the theory about how firms should be dealing with this massive change is itself in flux, transforming if you will, as organizations come to grips with the idea that the most basic ways they do business are being called into question.

Can Office Furniture Predict the Next Recession?

Have you ever worked in a mind-numbing cubicle? I did when I was younger, and I hated it.

Being stuck in a cramped cubicle lit by overhead fluorescent lights, wedged between dozens of coworkers whose phone conversations and keyboard strokes—as well as bodily odors and noises—sucked a little bit of life out of me every single day.

My cubicle experience made me feel like a white-collar prisoner, and I knew this was not how I wanted to spend my professional life. I needed to either move up the company ladder or start my own business.

Office-furniture sales suggest a recession is coming

The office furniture business is an extremely useful economic indicator. The ups and downs of this industry are not standalone indicators that you can use to time the market. They are, however, very good advance measures of overall economic health. After all, businesses only buy large amounts of office furniture—including the dreaded cubicle—when they are expanding their workforce and growing. That is why my bear market antenna started to twitch when I read the pessimistic outlooks of the largest office furniture and cubicle manufacturers in the world.

How the Government Miscalculated a Decade’s Worth of Construction Data

Yesterday, the U.S. Department of Commerce announced that construction spending dropped 0.4 percent in November. But it did so with one of the odder footnotes that it has ever printed: "In the November 2015 press release, monthly and annual estimates for private residential, total private, total residential and total construction spending for January 2005 through October 2015 have been revised to correct a processing error in the tabulation of data on private residential improvement spending."

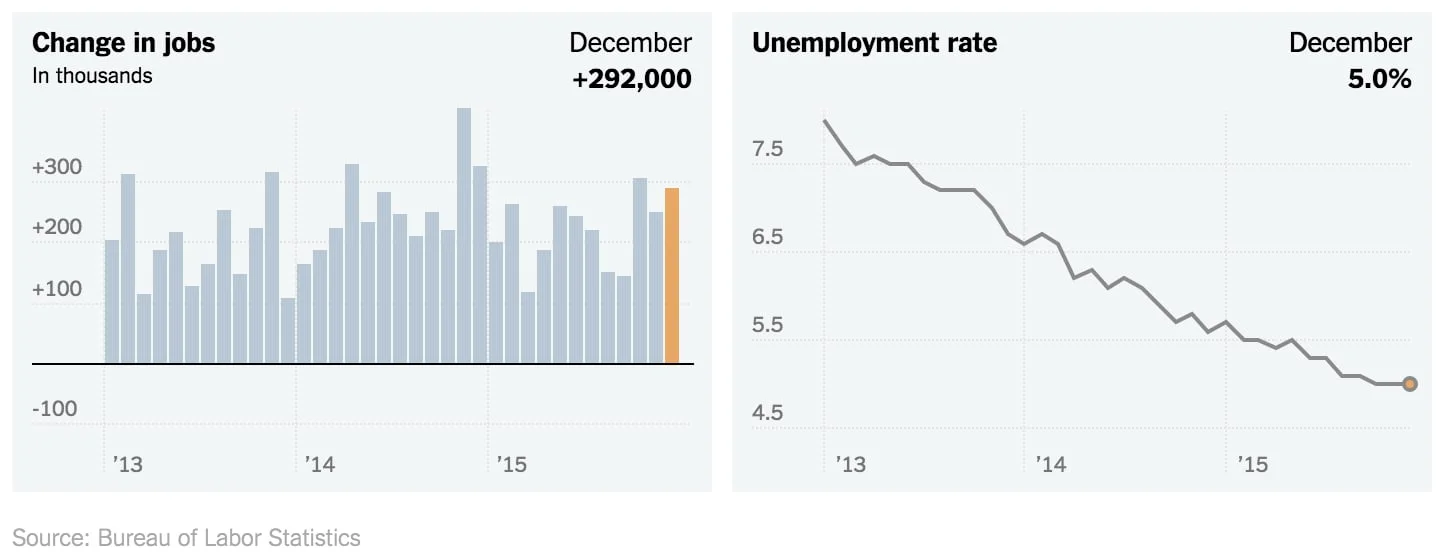

Robust Hiring in December Caps Solid Year for U.S. Jobs

In an impressive sprint at 2015’s end, employers added 292,000 workers to their payrolls in December, the government said on Friday, punctuating a year of healthy growth. The unemployment rate stayed at 5 percent last month, the Labor Department said, but that was mostly because large numbers of people went looking for work.