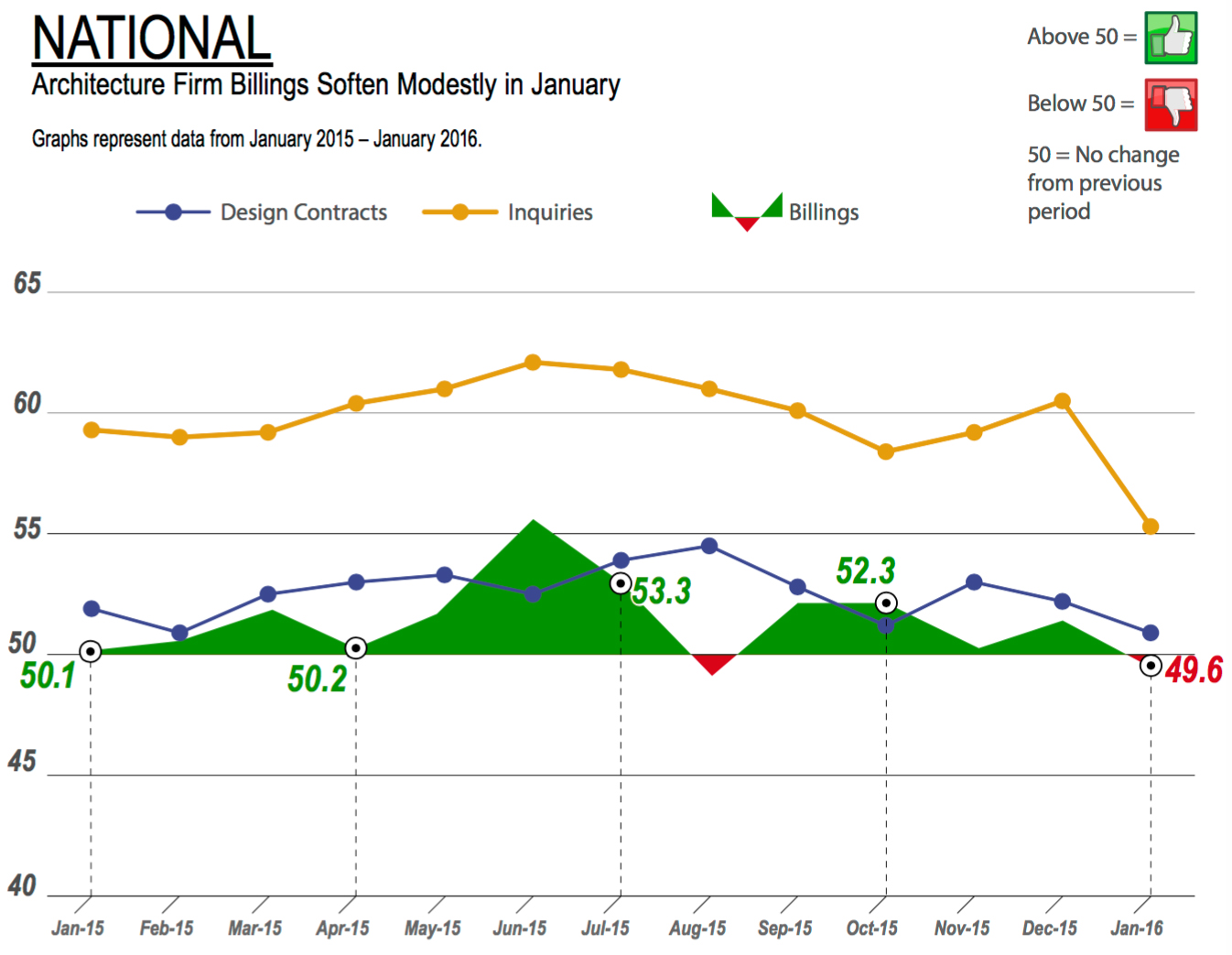

Business conditions at architecture firms softened modestly in January to start the new year. The Architecture Billings Index (ABI) score of 49.6 indicates that just slightly more firms reported a decrease in firm billings than reported an increase for the month (a score over 50 indicates billings growth). This decline may be partially attributable to a surge of winter weather in many regions of the country, after what had previously been a relatively mild winter. Firms are still reporting that they have a decent amount of work in the pipeline. Inquiries into new projects remained strong in January, and the value of new design contracts continued to increase as well, albeit at a slightly slower pace than in recent months.

Architecture firm billings increased at firms in all regions of the country except the Midwest in January, most notably at firms located in the Northeast, where a modest increase was reported for only the second time in the last year and a half. Increases were also modest for firms located in the South and West regions, while firms located in the Midwest reported declining firm billings for the third consecutive month.

Business conditions were also essentially positive for firms of all specializations. Firms with an institutional specialization reported a score of 49.9, indicating that there was essentially no change in firm billings from December to January. Business conditions at firms with a residential specialization continued to recover after a slight slump in mid-2015, while billings at firms with a commercial/industrial specialization were also essentially flat for the third consecutive month.

2015 was a good year overall for employment in the architectural services sector. The sector shed nearly 66,000 jobs during the years of the Great Recession, but as of the end of 2015, had added back 43% of those jobs that were lost. More than 10,000 positions were added in 2015 alone, bring current total employment in the sector to 180,300 – the highest it has been in nearly seven years. Employment in the larger economy remains strong as well: the unemployment rate declined from 5.7% to 4.9% over the last year, and nonfarm payrolls increased by 151,000 new hires in January.

While both housing starts and building permits for privately owned housing units declined from December to January, they have both increased, on average, over the last year. Building permits increased by 12.0% from 2014 to 2015, while housing starts increased by 10.8% in that same time period.

This month’s special practice questions asked architecture firms about their current project load. Firms reported that they have an average of 41 active projects on average, with their single largest project accounting for just over one quarter of their firm’s current billings (26%), and their top three largest active projects combined accounting for 51% of their firm’s current billings. Firms located in the Northeast region of the country reported the smallest average number of currently active projects (26), while firms located in the Midwest region reported the largest number (60).

Smaller firms reported having far fewer active projects than large firms (an average of just seven active projects at firms with annual billings of less than $250,000, compared to an average of 124 active projects at firms with annual billings of more than $5 million), but for small firms, those projects accounted for a much larger share of their billings. Their firm’s top three projects accounted for nearly two thirds of their firm’s billings, compared to just over one third of firm billings at large firms.

This month, Work-on-the-Boards participants are saying:

- • Improving. Construction costs have stabilized somewhat with drop in oil/gas related drilling and lower gas and diesel costs.

- —54-person firm in the South, mixed specialization

• Conditions seem to have stabilized at a pretty active level. We hired one staff member last month and could probably use another. - —5-person firm in the West, commercial/industrial specialization

• There is a long-term, slowly-improving trend in business conditions which continues, however, the volatility from firm to firm and from month to month has been very high and is not making a transition toward stability. - —4-person firm in the Northeast, residential specialization

• Projects tend to be tending down in size. Plenty of work to still pursue, but competition has been stiff. - —34-person firm in the Midwest, institutional specialization