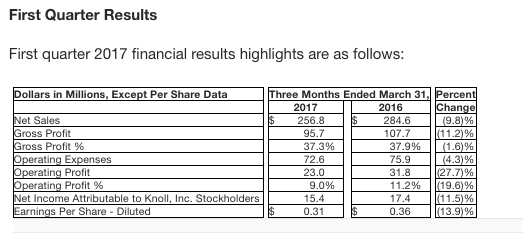

Knoll, Inc. (KNL), a leading designer and manufacturer of furnishings, textiles and fine leathers for the workplace and home, today announced results for the first quarter ended March 31, 2017. Net sales were $256.8 million for the first quarter, a decrease of 9.8%, from the first quarter of 2016. Operating profit for the quarter decreased to $23.0 million, or 27.7%, compared to operating profit of $31.8 million for the first quarter of 2016. Net income for the first quarter of 2017 was $15.4 million, a decrease of 11.5% when compared to the first quarter of 2016. Diluted earnings per share was $0.31 and $0.36 for the first quarter of 2017 and 2016, respectively.

“As expected, we had a slower start to the year as declines in our Office segment offset continued growth in our high design Studio segment and stability in our Coverings business,” commented Knoll President and CEO Andrew Cogan. “Our first quarter results, while down versus our very strong start to 2016, do demonstrate the benefits of our continuing strategy to diversify our sources of revenue into higher design, high margin, more residentially-oriented segments which do not have the volatility of our Office business.”

Net sales were $256.8 million for the first quarter of 2017, a decrease of 9.8%, from the first quarter of 2016. Net sales for the Office segment were $149.8 million during the first quarter of 2017, a decrease of 19.2%, when compared with the first quarter of 2016. The decrease in the Office segment was a result of a decline in both the quantity and average size of larger project opportunities in addition to a limited ship week at the end of March to facilitate the first phase of the implementation of a new ERP system. Net sales for the Studio segment were $79.1 million during the first quarter of 2017, an increase of 10.6%, when compared with the first quarter of 2016. This increase was driven by Europe and KnollStudio as well as to a lesser extent incremental sales from DatesWeiser, a designer and manufacturer of contemporary wood conference and meeting room furniture, which was acquired in the fourth quarter of 2016. Net sales for the Coverings segment were $27.9 million during the first quarter of 2017, an increase of 0.5%, when compared with the first quarter of 2016.

Gross profit for the first quarter of 2017 was $95.7 million, a decrease of $12.0 million, or 11.2%, when compared with the first quarter of 2016. During the first quarter of 2017, gross margin decreased to 37.3% from 37.9% in the first quarter of 2016. This decrease was driven mainly by the Office segment, where lower volume had an unfavorable impact on fixed-cost leverage, partially offset by increased sales in the high margin Studio and Coverings segments.

Total operating expenses were $72.6 million for the first quarter of 2017, or 28.3% of net sales, compared to $75.9 million, or 26.7% of net sales, for the first quarter of 2016. The decrease is due primarily to lower incentive accruals from decreased profitability, and lower sales commissions as a result of a reduction in volume in the Office segment partially offset by increased investments in training and costs related to the rollout of the Rockwell Unscripted product line.

Operating profit for the first quarter of 2017 decreased to $23.0 million, or 27.7%, compared to operating profit of $31.8 million for the first quarter of 2016. Operating profit for the Office segment was $8.8 million, or 5.9% of net sales, in the first quarter of 2017, a decrease of $11.1 million, or 55.8%, when compared with the first quarter of 2016. The decrease in operating profit for the Office segment was due primarily to lower sales volume partially offset by reduced performance based incentive accruals and lower sales commissions. Operating profit for the Studio segment was $11.6 million, or 14.7% of net sales, an increase of $1.2 million, or 11.0%, when compared with the first quarter of 2016. Operating profit for the Coverings segment was $6.2 million, or 22.3% of net sales, a decrease of $0.5 million, or 7.2%, when compared to the first quarter of 2016. Corporate costs were $3.6 million, a decrease of $1.6 million, or 30.3%, when compared to the first quarter of 2016.

During the first quarter of 2017, other expense was $0.2 million compared to $2.6 million for the first quarter of 2016. Other income and expenses are primarily related to foreign exchange gains and losses. Other expense in the first quarter of 2016 was primarily related to foreign exchange losses that resulted from the revaluation of intercompany balances between our Canadian and US entities.

Net income for the first quarter of 2017 was $15.4 million, or $0.31 diluted earnings per share, compared to $17.4 million, or $0.36 diluted earnings per share, for the first quarter of 2016.

The tax rate for the first quarter of 2017 was 27.2% down from 37.1% in the first quarter of 2016. The change in the tax rate was due primarily to the early adoption of ASU 2016-09 in the third quarter of 2016, which impacted the tax treatment of the vesting of a large quantity of equity awards. This resulted in the realization of tax benefits recognized as a reduction of income tax expense. In addition, the tax rate was affected by the mix of pretax income and the varying effective tax rates in the countries and states in which we operate.

Capital expenditures for the first quarter of 2017 totaled $10.7 million compared to $7.0 million in the first quarter of 2016. During the first quarter of 2017, the Company paid accrued dividends on vested shares of $1.1 million in addition to a quarterly dividend of $7.3 million, or $0.15 per share, compared to a quarterly dividend of $7.2 million, or $0.15 per share, in the first quarter of 2016.