Interface, Inc., a worldwide modular flooring company and global leader in sustainability, Thursday announced results for the fourth quarter and fiscal year ended December 31, 2017.

"We continued to execute against our value creation strategy in the fourth quarter, delivering strong results in line with our expectations for top line growth, gross margin expansion, and SG&A control," said Jay Gould, CEO of Interface. "In the fourth quarter, we delivered solid performance down the P&L with organic sales growth of 11% with contribution across our core carpet and LVT businesses. Gross margin of 38.2% was up 60 basis points over the prior year period as we continued to see benefits of our productivity initiatives. We also held fourth quarter SG&A expenses at $71.2 million, or 26.8% of net sales, only a slight increase year over year due to higher incentive-based compensation on stronger performance this year versus last year. Excluding the impact of the new Tax Act, we delivered adjusted EPS of $0.32, up 14% versus last year."

Fourth Quarter 2017 Financial Summary

The fourth quarter included $15.2 million of provisional tax expenses ($0.25 per share) due to the U.S. Tax Cuts and Jobs Act ("Tax Act") enacted on December 22, 2017. These expenses are principally from the one-time transition toll tax on accumulated foreign earnings and required changes to deferred tax assets and liabilities.

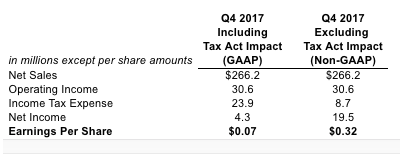

This summary table highlights the impact of the Tax Act in the fourth quarter:

Sales: On a GAAP basis, fourth quarter net sales were $266.2 million, up 11.1% over the prior year period. Organic sales in the fourth quarter increased 10.9% versus the fourth quarter last year.

Organic orders (which excludes the impact of foreign currency fluctuations and the exited FLOR specialty retail stores) were up 8% year over year, with increases across both the core carpet tile business and the new LVT modular resilient flooring business.

Operating Income: Fourth quarter operating income was $30.6 million, or 11.5% of sales, up 60 basis points compared with adjusted operating income of $26.2 million, or 10.9% of sales, in the prior year period. As reported, operating income for the fourth quarter of 2016, which included a $19.8 million restructuring and asset impairment charge, was $6.4 million, or 2.7% of net sales.

Gross margin was 38.2% for the fourth quarter, an increase of 60 basis points over the prior year period, driven by productivity initiatives offset partially by raw material cost inflation.

In line with expectations, SG&A expenses in the fourth quarter were $71.2 million, or 26.8% of sales, compared to $63.8 million, or 26.6% of sales, in the fourth quarter of 2016. This 20 basis point increase is a result of additional incentive-based compensation driven by performance goal achievement that outpaced the prior year period.

Net Income and EPS: Net income during the fourth quarter of 2017 was $4.3 million, or $0.07 per share, compared to the prior year period net income of $4.7 million, or $0.07per share. Fourth quarter 2017 adjusted net income (which excludes the previously mentioned $15.2 million of provisional tax expense due to the Tax Act), was $19.5 million, or $0.32 per share, compared to fourth quarter 2016 adjusted net income (which excludes restructuring and asset impairment charges) of $17.8 million, or $0.28 per share.

Share Repurchases: The Company completed an additional $10.5 million of stock repurchases in the fourth quarter, executing on the previously announced $100 millionshare repurchase program.

Fiscal Year 2017 Financial Results

As previously noted, the fourth quarter 2017 included $15.2 million of provisional tax expenses ($0.25 per share) due to the Tax Act. In addition, the first quarter of 2017 included restructuring and asset impairment charges due largely to exiting the FLOR specialty retail business.

This summary table highlights the impact of those expenses and charge on fiscal year 2017:

Sales: On a GAAP basis, net sales in 2017 were $996.4 million, up 3.9% compared with $958.6 million in 2016. Organic sales grew 5.0% over the same period. Organic orders grew 6.1% year over year. Carpet tile and LVT sales contributed relatively equally to organic sales and organic order growth in 2017.

Operating Income: On a GAAP basis, operating income was $109.8 million, or 11.0% of sales in 2017, compared to $84.9 million, or 8.9% of sales, in 2016. Adjusted operating income, which excludes restructuring and asset impairment charges in both 2017 and 2016, was $117.1 million, or 11.8% of sales, in 2017, compared to adjusted operating income of $104.7 million, or 10.9% of sales, in 2016.

Gross margin of 38.7% was up 20 basis points compared to 2016.

SG&A expenses of $268.9 million, or 27.0% of net sales, were down 50 basis points versus $263.9 million, or 27.5% of net sales, in 2016.

Net Income and EPS: The Company reported net income of $53.2 million, or $0.86 per share, in 2017, compared with $54.2 million, or $0.83 per share, in 2016. When adjusted to exclude the Tax Act impacts as well as restructuring and asset impairment charges, net income was $73.1 million, or $1.18 per share, in 2017, compared with $67.3 million, or $1.03 per share, in 2016.

Share Repurchases: The Company completed $91.6 million of stock repurchases in 2017 as part of the previously announced share repurchase programs.

Fiscal Year 2018 Outlook

As Interface looks forward to 2018's full year goals, it is targeting to achieve 3 - 5% organic sales growth, gross profit margin of 39 - 39.5%, SG&A expenses that are relatively flat to 2017 as a percentage of net sales, an effective tax rate of 26 - 27%, interest and other expenses that are projected to be $2 million to $3 million higher than 2017, and capital expenditures of $50 million to $60 million. Based on historic seasonality, current forecasts, and prior year comparables, the Company expects its strongest operating income growth in the second and third quarters of 2018, with softer growth in the first and fourth quarters.