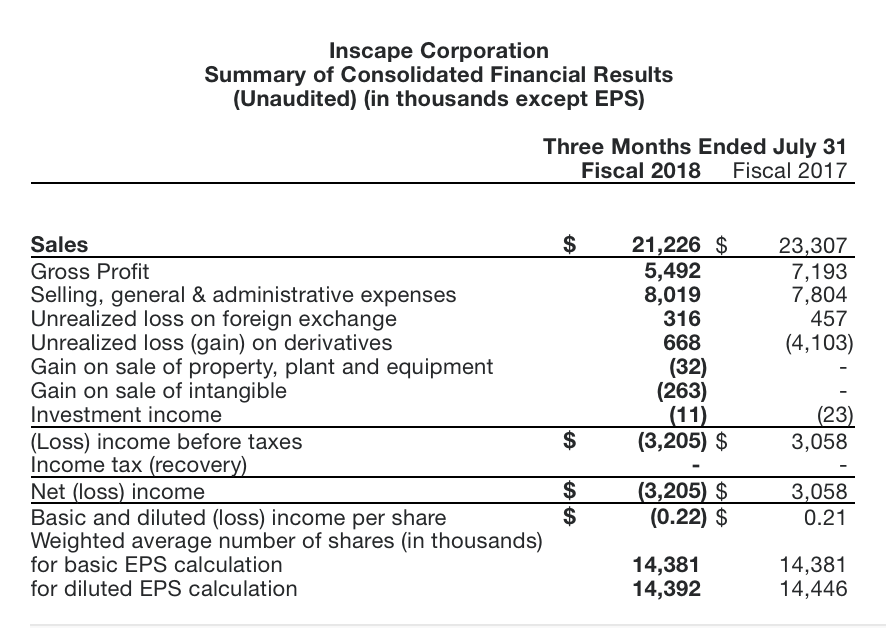

Inscape Wednesday announced its first quarter financial results ended July 31, 2018. Sales in the first quarter of fiscal year 2019 was $21.2 million which was 9% lower than the same quarter of the prior year. As previously reported, Inscape was working towards exiting a partnership with retailer West Elm. The transition was completed on June 30, 2018 and the company says it has refocussed its resources to its core business. Excluding the impact of the non profitable business unit, sales in the current quarter would have been 6% lower than the prior year.

“Our financial performance reflects incremental investments and cost saving initiatives consistent with our strategic plan to deliver profitable long term growth. Current quarter sales were impacted by the exit of a non profitable business unit and timing of shipments. Gross profit in the current quarter was impacted by incremental costs of $0.6 million for new product development and supply chain efficiency initiatives. The efficiency improvements are expected to generate in excess of $1.5 million in annual cost savings. The Company has identified and is evaluating additional cost saving opportunities to be implemented in fiscal 2019,” said Brian Mirsky, CEO. “We strongly believe that these investments are critical to accelerating profitable growth. Early indications are that these initiatives are working as our sales orders for our core business and orders for our new benching system called RockIt are trending upwards.”

The first quarter of fiscal year 2019 ended with a loss of $3.2 million or 22 cents per share, compared with a net income of $3.1 million or 21 cents per share in the same quarter of last year. Net income (loss) of both quarters included certain unrealized, non-cash expenses and one-time items that have significant impact on the net income per GAAP. With the exclusion of these items, the first quarter of fiscal 2019 had an adjusted net loss of $2.5 million, compared with adjusted net loss of $0.4 million in the same quarter of last year.

Gross profit as a percentage of sales for the first quarter of fiscal year 2019 at 25.9% was 5 percentage points lower than last year’s 30.9%. The unfavourable impact of lower volume, sales mix and costs incurred to improve manufacturing efficiencies negatively impacted the margin for the quarter.

Selling, general and administrative expenses (“SG&A”) in the first quarter of fiscal year 2019 were 37.8% of sales, compared to 33.5% in the same quarter of last year. The dollar amount increased by $0.2 million compared to the same quarter of last year. The increase includes investments in marketing and sales coverage initiatives.

At the end of the quarter, the company was debt-free and had cash, cash equivalents and short-term investments totaling $6.0 million and an unused credit facility.