Solomon Coyle, a business management consultancy serving the contract furniture industry, announced that results of their YE2018 dealer benchmark survey have been released for dealer use.

Participating dealerships can register for a guided tour of those results during one-hour webinars that Solomon Coyle will conduct between May 7 and May 15. The primary focus will be Solomon Coyle’s enhanced executive summaries of dealer performance based on submitted data in terms of the Solomon Coyle Key Performance Indicators.

Webinar attendees will also see demonstrations of how to use Solomon Coyle’s online benchmark report tool to find and apply data comparisons that are relevant to the dealer’s business and offer high potential for sparking performance-improvement initiatives.

“We appreciate everything that Allsteel, Haworth, Herman Miller, Knoll and Steelcase – the sponsors of this annual research – do to make the program possible and to encourage their respective dealer networks to complete the survey and reap the benefits,“ said David Solomon, the firm’s managing principal and founder. “The Solomon Coyle team wants to do everything we can to provide context for the survey data and help dealers leverage the data to sharpen their strategic focus, uncover opportunities, and improve profitability.”

Access to the anonymous survey data and to the Solomon Coyle KPI commentaries is exclusive to survey participants. To gain access, dealers must submit a completed survey that makes it all the way through the Solomon Coyle quality assurance process. Solomon Coyle has continually refined the process over many years to provide assurance that whatever conclusions a participating dealer may draw while working with the survey data are grounded in apples-to-apples comparisons.

Solomon Coyle is willing to publicly share certain data points that shed light on the participant pool for the YE2018 survey and, hopefully, will encourage even wider participation in future surveys:

(1) More than 250 dealer responses have been received. As of May 1, the number of verified surveys was approaching 240 and Solomon Coyle’s QA team was still assisting 20 additional dealers with procedural revisions and corrections to otherwise disqualifying data.

(2) There was a notable rise of 10% in submissions by Haworth dealers.

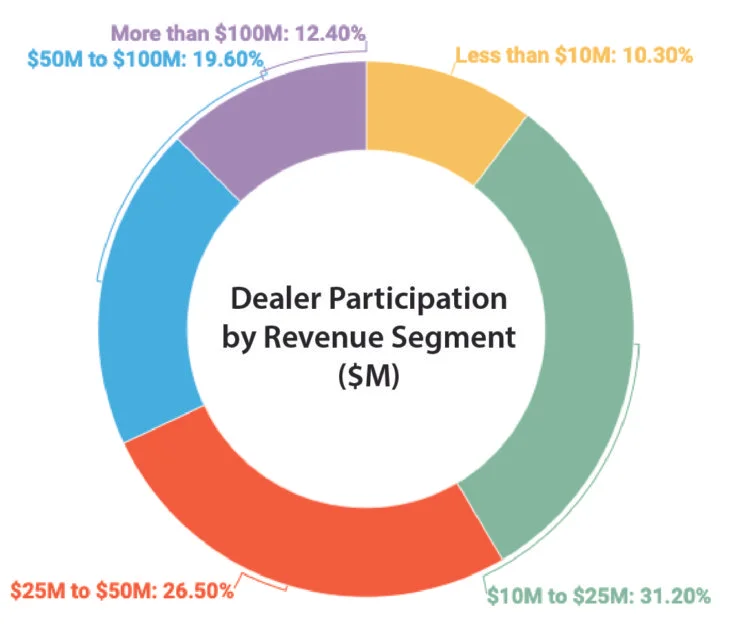

(3) The opportunity to benchmark was attractive to dealers of all sizes. The composition of participants by revenue size was as follows:

>> Less than $10 million: 10.3%

>> $10 million–$25 million: 31.2%

>> $25 million –$50 million: 26.5%

>> $50 million –$100 million: 19.7%

>> More than $100 million: 12.4%

(4) Total revenue (all products and services) for all reporting dealers was $12 billion.

(5) Total employees for all reporting dealers was 19,071.

(6) Wages and benefits totaled $1.8 billion.

(7) The average dealer revenue for YE2018 was $51.9 million. From 2014 to 2018, average revenue rose by 26.2%.

(8) The average operating profit was 2%.

(9) On average, the reporting dealers processed 5,677 orders, an increase of 10% over 2017. The average order size – $10,900 – saw a 3% increase over 2017.

(10) Service Sales increased 6% from 2017 to 2018.

(11) Regarding diversification: Between 2017 and 2018, there was a 15% increase in the number of dealers reporting sales of architectural products and a 33% increase in the number of dealers reporting sales of Technology/AV.

(12) Regarding the Sales function: Sales staff (including sales, sales support, marketing, design and project management) increased by 5.7% on average from 2017 to 2018. Dealers reported an average of 2.01 support staff per salesperson. Design and project management expense rose 14% from 2014 to 2018.

There is an ongoing Solomon Coyle email campaign inviting qualified dealers to register for the May webinars. Two dates and times are offered for each of the five dealer networks involved in the survey.

Solomon Coyle, LLC, provides research, education, consulting, peer group management, and business intelligence services aimed at helping contract furniture dealers improve operational performance and profitability. More at solomoncoyle.com.