Demand for design services in August took a markedly downward swing compared to July’s already soft score, according to a new report released from The American Institute of Architects (AIA).

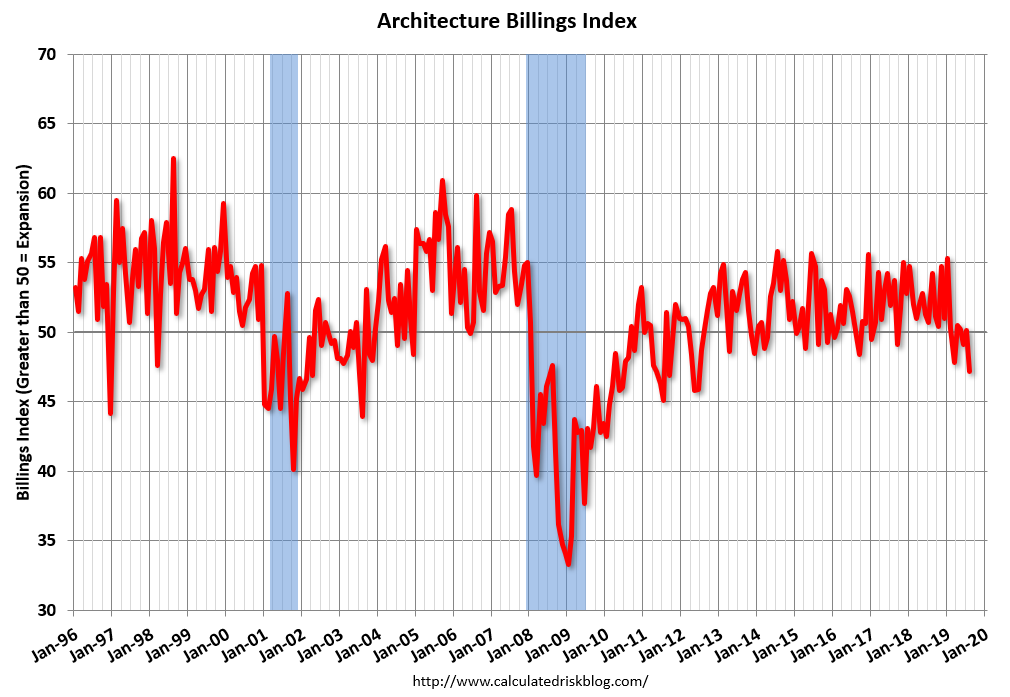

AIA’s Architecture Billings Index (ABI) score of 47.2 in August showed a significant drop in architecture firm billings compared to the July score of 50.1. Any score below 50 indicates a decrease in billings. The design contracts score also declined to 47.9 in August, representing a rare dip for this indicator. Billings in the West stayed modestly positive while all other regions remained in negative territory.

“The sizeable drop in both design billings and new project activity, coming on the heels of six months of disappointing growth in billings, suggests that the design expansion that began in mid-2012 is beginning to face headwinds,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Currently, the weakness is centered at firms specializing in commercial/industrial facilities as well as those located in the Midwest. However, there are fewer pockets of strength in design activity now, either by building sector or region than there have been in recent years.”

...

• Regional averages: West (51.2); Northeast (49.1); South (48.2); Midwest (46.4)

• Sector index breakdown: institutional (50.6); multi-family residential (50.5); commercial/industrial (46.9); mixed practice (46.3)

This graph shows the Architecture Billings Index since 1996. The index was at 47.2 in August, down from 50.1 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 9 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest six month stretch since 2012, and might suggest some decline in CRE investment in 2020.

Read more at https://www.calculatedriskblog.com/2019/09/aia-substantial-decline-in-architecture.html#0MS7chQLjWgmEHOG.99