DIRTT Environmental Solutions Ltd., an interior construction company that uses proprietary software to design, manufacture and install fully customizable environments, announced its financial results for the three months ended June 30, 2021. All financial information is presented in U.S. dollars, unless otherwise stated.

Second Quarter 2021

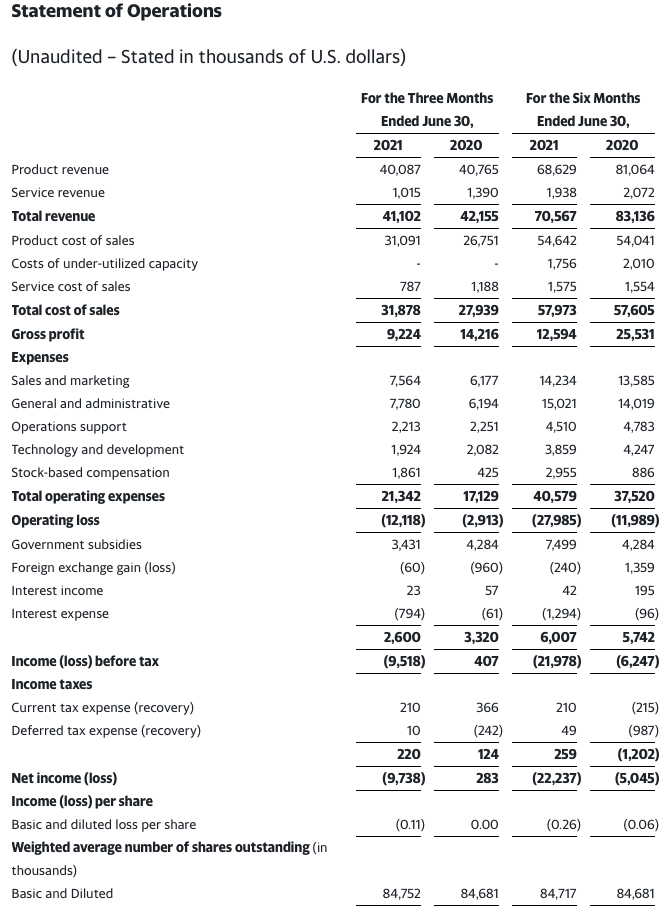

Revenue of $41.1 million

Gross profit margin of 22.4%

Adjusted Gross Profit Margin1 of 27.4%

Net loss of $9.7 million

Net loss margin of (23.7%)

Adjusted EBITDA1 of ($6.8) million

Adjusted EBITDA Margin1 of (16.6%)

Cash balance of $58.3 million

Management Commentary

“Second quarter revenue was nearly forty percent higher than first quarter revenue, strengthening our conviction that the first quarter of 2021 represented the trough of our pandemic-impacted revenue,” stated Kevin O’Meara, chief executive officer. “We are pleased with the progress we have been making in implementing our strategic plan, but the environment in which we are working continues to be uncertain. We are closely monitoring potential surges in COVID infection rates and the resulting impact on demand, labor availability, supply chains and our own operations.

“While there has been a broad resumption in non-residential construction activity, many of our clients are experiencing long schedule delays due to a combination of permitting backlogs and material and labor challenges in conventional construction. Our ability to deliver on short lead times is a distinct advantage, helping our clients offset some of these delays, but as DIRTT is installed in the final stages of a project, the delays are negatively impacting the timing of our project delivery, shifting some of them from the second half of 2021 into 2022. As a result, we are now expecting a slower pace of revenue growth recovery in the second half of 2021, with third quarter revenue anticipated to be similar to the second quarter.

“Despite the slower-than-anticipated return to year-over-year revenue growth, we remain encouraged by sales activity levels within the business. We are capitalizing on the increasing interest in flexible, adaptable spaces and prefabricated offsite construction as companies emerge from the pandemic, reoccupy their space and explore new ways of working together. We have strengthened our network of distribution partners, adding 3 new partners during the quarter and are finalizing the onboarding of two general contractors that we expect will join our distribution partner network in the third quarter. Client tours, both virtual and in-person, at our DIRTT Experience Centers (DXCs) hit a 30-month high in June and we continue to expand our strategic account relationships in various stages of development. We have been successful on a number of large strategic account requests for proposal, which we define as being projects exceeding $2 million, with delivery dates beginning in 2022.”

Mr. O’Meara concluded, “We believe our success in prudently executing our strategic plan has positioned us to capitalize on growing sales opportunities as non-residential construction recovers from the COVID-19 pandemic. Our enhanced commercial and manufacturing capabilities are building the foundation for what we believe will be long term, profitable and sustainable revenue growth. We look forward to continuing to leverage the increased brand strength from our strategic marketing initiatives by resuming our annual sales event, Connext, in Chicago in October and by showcasing an inspiring experience of the full scope of the DIRTT solution at the grand opening of our new Dallas DXC late in the third quarter.”

Second Quarter Financial Review

Revenue for the second quarter of 2021 was $41.1 million, a decline of $1.1 million or 2% from the same period of 2020. For the three months ended June 30, 2021 revenues returned to quarterly ranges experienced in the first half of 2020 and have increased by $11.6 million from the first quarter of 2021.

Gross profit for the three months ended June 30, 2021 was $9.2 million or 22.4% of revenue, a decline of $5.0 million or 35% from $14.2 million or 33.7% of revenue for the three months ended June 30, 2020. The reduction was attributable to $1.3 million of higher transportation costs due to third party trucking cost increases, $1.3 million of higher direct material costs due to the combined impact of a 5% increase in the cost of materials and a specialized project that required additional third party manufactured inputs, $0.5 million of incremental costs related to our new Rock Hill plant as well as an estimated $1.1 million impact of a stronger Canadian dollar on Canadian based manufacturing costs. In addition, the three months ended June 30, 2020 included a $1.2 million reversal of a timber provision that did not reoccur in 2021.

Adjusted Gross Profit for the three months ended June 30, 2021 was $11.3 million or 27.4% of revenue, a $4.9 million or 30% decline from $16.1 million or 38.2% of revenue for the three months ended June 30, 2020 for the reasons described above.

Sales and marketing expenses increased by $1.4 million to $7.6 million for the three months ended June 30, 2021, from $6.2 million for the three months ended June 30, 2020. The increases during the quarter were largely related to increased salary and wage expenses as we continue to build our sales organization and $0.3 million of staff transferred from Technology and Development to Sales and Marketing, higher depreciation expense as we completed our Chicago DXC in 2020, offset by lower commission expense. Travel and meals and entertainment expenses increased as restrictions on travel have eased. As economies re-open, we anticipate travel, meals and entertainment expenses will increase over current levels, the timing and amount of such expenses, however, are indeterminate at this time.

General and administrative expenses (“G&A”) increased by $1.6 million to $7.8 million for the three months ended June 30, 2021, from $6.2 million for the three months ended June 30, 2020. The increase was the result of the impact of the stronger Canadian dollar on our cost structure, higher salaries and benefits expenses, inclusive of a one-time severance cost, and professional fees, partially offset by decreased variable compensation costs.

Operations support expenses decreased by $0.1 million to $2.2 million for the three months ended June 30, 2021, from $2.3 million for the three months ended June 30, 2020, due to higher capitalized labor associated with internal capital projects.

Technology and development expenses decreased by $0.2 million to $1.9 million for the three months ended June 30, 2021, compared to $2.1 million for the three months ended June 30, 2020, primarily related to staff transferred to Sales and Marketing.

Net loss for the three months ended June 30, 2021 was $9.7 million compared to net income of $0.3 million for the three months ended June 30, 2020. The higher net loss is primarily the result of the above noted reduction in gross profit, a $4.2 million increase in operating expenses, which was largely due to increased stock based compensation, one-time severance costs and salary and wage expenses as we continue to build our sales organization and execute on our strategic plan and increased activity due to the easing of COVID-19 restrictions, a $0.9 million reduction of government subsidies and a $0.7 increase in interest expense as well as the estimated $1.3 million impact of a stronger Canadian dollar on Canadian based operating expenses. These amounts were partially offset by a $0.9 million reduction in foreign exchange losses.

Adjusted EBITDA (see “Non-GAAP Financial Measures”) for the quarter ended June 30, 2021 was an $6.8 million loss or (16.6%) of revenue, a decline of $7.1 million from $0.3 million, or 0.6% of revenue, for the quarter ended June 30, 2020 for the above noted reasons.